Press Round-Up Short (Premium)

Thursday newspaper round-up: Matchesfashion, Burberry, Boeing

The UK competition watchdog has stepped up its scrutiny of big tech involvement in artificial intelligence startups, asking for comment on three deals by Microsoft and Amazon. The Competition and Markets Authority (CMA) announced that it was examining Microsoft’s investment in the French firm Mistral and the hiring of the DeepMind co-founder Mustafa Suleyman as head of the US company’s new AI division. The watchdog is also scrutinising Amazon’s $4bn (£3. 2bn) investment in the US AI firm Anthropic.

Wednesday newspaper round-up: UK banks, Tesla, KPMG

UK banks are leaving themselves open to “severe, unexpected losses”, by failing to properly measure how exposed they are to the $8tn private equity industry, the Bank of England has warned. In a speech on Tuesday, Rebecca Jackson, a senior executive at the central bank, said there was a “creeping sense of complacency” among lenders, who – despite a boom in loans and financing to the sector – had almost no ability to put together data “or even appreciate its crucial importance”.

Tuesday newspaper round-up: P&O Ferries, TikTok, CVC

P&O Ferries seafarers have been told they will benefit from new French legislation that could double their pay, in what appears to be a significant U-turn by the controversial ferry operator. The move comes more than two years after P&O enraged the UK and French governments by sacking 786 workers and then taking advantage of a legal loophole to hire replacements on pay rates of below the minimum wage. – Guardian.

Monday newspaper round-up: Renewable energy, BlackRock, Frasers Group

A development company that sells off land no longer needed by Thames Water has paid out a £14m dividend despite warnings that it could become engulfed by the water group’s financial woes. Accounts filed at Companies House show Kennet Properties paid out a £14. 5m dividend in the year to 31 March 2023 despite the difficulties faced by the wider group, which is facing going into administration. – Guardian.

Sunday newspaper round-up: IDS, Ocado, Foxtons

Asset manager Redwheel told regulators they should reduce the UK postal service's legal obligations. The move followed a failed buyout attempt by Daniel Kretinsky for International Distributions Services, its parent company. The billionaire investor was said to be evaluating a possible improved bid. The company meanwhile has petitioned Ofcom to let it cut the number of days per week during which it must deliver second-class mail from six to two or three. That would save the company £300m and see it shrink its workforce by 1,000.

Friday newspaper round-up: Thames Water, Netflix, consumer confidence

“Misleading” and “inconsistent” labels make it hard for shoppers to know where their food comes from, the consumer champion Which? has said, as it found supermarket chains were selling products with “meaningless” statements on their packaging. Retailers must supply the “country of origin” for specific foods including fresh fruit and vegetables, unprocessed meats, fish, wine and olive oil but the rules do not generally apply to processed meat or frozen or processed fruit and vegetables.

Thursday newspaper round-up: Royal Mail, welfare bill, Boeing, Alstom, Federal Reserve

The Labour Party is open to the prospect of a takeover of the owner of Royal Mail by the struggling postal group’s Czech billionaire investor, which is considering a renewed approach. EP Group, a conglomerate controlled by Daniel Kretinsky, revealed on Tuesday that it had made a “non-binding indicative proposal” to the board of International Distributions Services (IDS), Royal Mail’s parent company, on April 9 seeking its recommendation for a possible cash offer for the remainder of the shares it does not already own.

Wednesday newspaper round-up: IMF, champagne, Boeing, Plus500, Trump Media

Rising energy prices and disruption to international shipping risk “stalling” declines in inflation in leading economies, the International Monetary Fund has warned, telling central banks that the “last mile” of their battle against price rises may be the hardest. In its latest assessment of global financial stability, the IMF said markets were vulnerable to another round of volatility if investors continued to push back their expectations for interest rate cuts this year, leading to falls in bond and stock prices.

Tuesday newspaper round-up: Tesla, Trump trial, Boeing, Thames Water, Apple

Tesla is to cut more than 14,000 jobs as Elon Musk’s groundbreaking electric car company feels the heat of a global price war with Chinese rivals at the same time as stalled demand for zero-emission vehicles. In an email to staff amid reports that workers in California and Texas have begun receiving redundancy notices, Musk stated: “As we prepare the company for our next phase of growth, it is extremely important to look at every aspect of the company for cost reductions and increasing productivity.

Monday newspaper round-up: Barclays, Middle East, fuel prices, oil exploration, tax havens

A 20-year-old children’s charity that shut down after an error by Barclays led to its account being closed was offered only £250 in compensation by the bank. JusB, which worked with young people from disadvantaged backgrounds, initially was offered the sum along with an apology for a mistake that resulted in the charity being cut off from its finances for nearly a month last year. This offer was increased later to £525, which Sir Robert Neill, the charity’s constituency MP, called “trivial” and said “bears no relation to the harm done”.

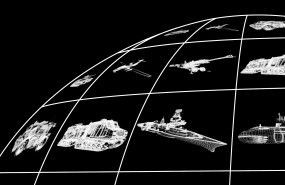

Sunday newspaper round-up: Middle East, Aston Martin, Defence

Britons must accept that their country was now involved in the Middle East conflict, Tobias Ellwood said. The former defence minister warned that "nobody was in full control" of the growing conflict as more and more countries were sucked in. Ellwood also said that Tehran's strike had taken the conflict into a "new dangerous territory". - Sunday Telegraph.

Friday newspaper round-up: Everton, AstraZeneca, Amazon

Everton has paid about £30m in interest charges to an opaque lender associated with a tax exile, corporate records suggest. The charges appear to have reached about £438,000 a week, according to the troubled Premier League club’s most recent set of accounts, a figure more than three times the reported wages of the Everton and England goalkeeper Jordan Pickford. – Guardian.

Thursday newspaper round-up: Border controls, McKinsey, KPMG

New post-Brexit UK border controls coming into force later this month will cost British businesses £2bn and fuel higher inflation, according to a report warning that UK-EU trade will be damaged as a result. With less than a month before the introduction of new checks on animal and plant products from 30 April, the insurer Allianz Trade said the controls agreed under Boris Johnson’s Brexit deal could add 10% to import costs over the first year. – Guardian.

Wednesday newspaper round-up: Shoplifting, EnQuest, Klarna

The government is investing more than £55m in expanding facial recognition systems – including vans that will scan crowded high streets – as part of a renewed crackdown on shoplifting. The scheme was announced alongside plans for tougher punishments for serial or abusive shoplifters in England and Wales, including being forced to wear a tag to ensure they do not revisit the scene of their crime, under a new standalone criminal offence of assaulting a retail worker.

Tuesday newspaper round-up: Pharma companies, Puig, Thames Water

Rachel Reeves has said an incoming Labour government would launch a £5bn crackdown on tax avoiders to close a gap in its spending plans exposed by Jeremy Hunt scrapping the non-dom regime to finance tax cuts. Warning households and businesses that Labour was prepared to adopt tough measures to tackle tax fraud and non-compliance, Reeves said the funding would be used to pay for free school breakfast clubs and additional NHS appointments. – Guardian.

Monday newspaper round-up: Boeing, rent rises, e-scooters, Santander UK

US airline regulators have launched an investigation after an engine cowling on a Boeing plane fell off during takeoff and struck the wing flap. The Southwest Airlines flight 3695 rose to about 10,300ft (3,140 metres) before returning safely 25 minutes after takeoff to Denver international airport at about 8. 15am local time on Sunday. It was towed to the gate after landing. The Boeing aircraft with 135 passengers and six crew members aboard had been headed to Houston.

Sunday newspaper round-up: Investment trusts, LSE Group, Thames Water

Some of London's biggest investment trusts are looking at the possibility of moving to Switzerland in order to dodge rules that make them overstate how much they charge clients. Under leftover EU rules, UK-listed investment trusts disclose charges that are far higher than what investors pay in reality. The news follows enormous drops in value since 2022, when the rules came into effect, according to data from AJ Bell. - Financial Mail on Sunday.

Friday newspaper round-up: Energy bills, working from home, music industry

The number of households seeking help to deal with court action over their unpaid energy bills has doubled in the last year, according to Citizens Advice. The charity said suppliers were increasingly opting to take their customers to court to recover their energy debts, which could ruin household finances for years. It said the use of legal action to pursue unpaid bills appeared to have increased since the industry regulator, Ofgem, introduced strict restrictions on the forced installation of prepayment meters.

Thursday newspaper round-up: Elon Musk, Dr Martens, HSBC

Delivery app riders pedalling through cities and tailbacks at drive-throughs were familiar signs of Britain’s hunger for takeaway food at the peak of the Covid pandemic. Now a study suggests it became an enduring habit. After a boom in orders on Deliveroo, Just Eat and other platforms by locked-down consumers, research by the Institute for Fiscal Studies (IFS) suggests the popularity of takeaways, meal deliveries and food-on-the-go bought from retailer such as sandwiches and crisps has remained above pre-pandemic levels after the removal of Covid restrictions.

Wednesday newspaper round-up: Thames Water, Shell, Nationwide

A bond issued by Thames Water’s parent company has fallen to record lows as the embattled company scrambles to secure its future, and the government signalled it is “ready to step in if necessary”. The £400m bond, issued by the water supplier’s parent company, Kemble, has slumped to only 14. 4p after shareholders indicated that they were unwilling to inject further funds into the heavily indebted utility company. – Guardian.